mobile county al sales tax registration

10 rows Alabama Legislative Act 2010-268 now mandates that customers using a Visa or. In Mobile or our Downtown Mobile office at 151 Government St.

Contact Us Alabama Department Of Revenue

Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd.

. In Mobile Downtown office is open on Monday and Friday only. If sales tax is being charged for financing purposes. Income Tax Rate Indonesia.

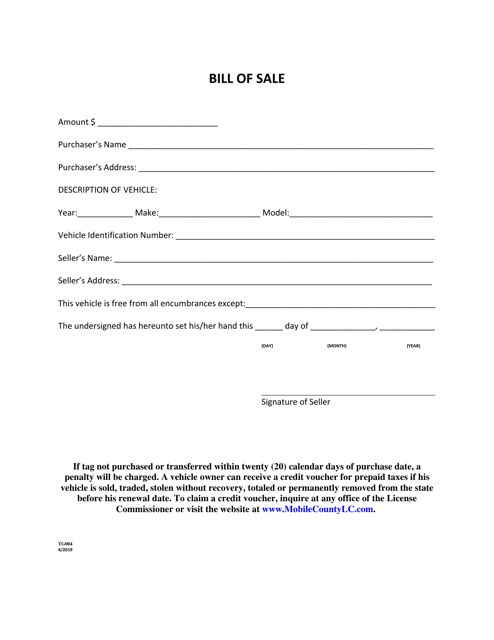

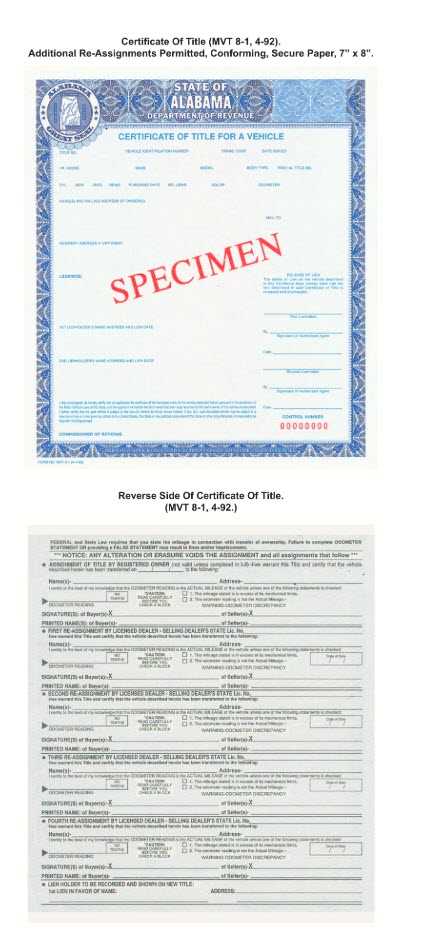

For tax information. If purchased from an alabama dealer the title application should be provided. It is the sellers responsibility to obtain and keep on file the purchasers valid sales tax number or exemption number.

Your Premium Gym in District 69. Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may call ALTIST Certified Auditors Complaint Hotline. Mobile AL Tax Liens and Foreclosure Homes.

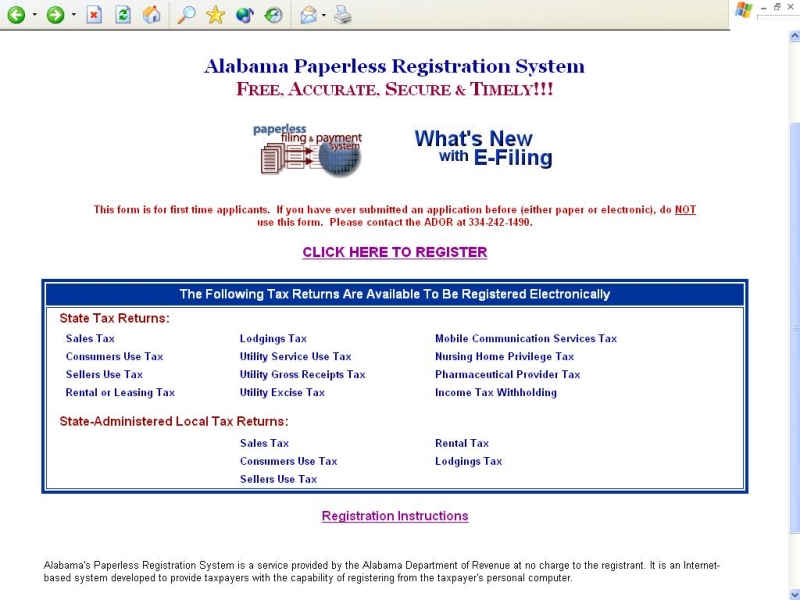

Revenue Office Government Plaza 2nd Floor Window Hours. Online Filing Using ONE SPOT-MAT. State Alabama Sales Tax Registration information registration support.

Soldier For Life Fort Campbell. Sales Use. Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions Financial Reports Revenue Department.

A mail fee of 250 will apply for customers receiving new metal plates. Opry Mills Breakfast Restaurants. Once you register online it takes 3-5 days to receive an account number.

Applicable interest will be assessed beginning February. For additional information contact the City of Mobile Revenue Department at 251 208-7462. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100.

Via the Alabama Motor Fuels Single Point Filing system - httpsmyalabamataxesalabamagov Returns are due on or before the 20th of each month. NOTICE TO PROPERTY OWNERS and OCCUPANTS. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal Staff may visit your property to review or update property information.

Restaurants In Matthews Nc That Deliver. In completing the CityCounty Return to filepay Montgomery County. 243 PO Box 3065 Mobile AL 36652-3065 Office.

Business entities that file and pay Mobile County Sales Use Lease Automotive Lodging and Mobile County School Sales and Use Taxes should file and pay using the ONE SPOT system accessible through the State of Alabama My Alabama Taxes MAT website. Sales Use administers collects and enforces several different taxes including sales tax and consumers tax and is responsible for administering collecting and enforcing those tax types. Effective JUNE 1 2022 please begin remitting sales business tax and business license returns and payments to the remittance address below.

Essex Ct Pizza Restaurants. Please note however that the monthly discount may not exceed 40000. However pursuant to Section 40-23-7 Code of Alabama 1975 th in order to file quarterly bi-annually or annually for that calendar year.

334-625-2994 Hours 730 am. Instructions for Uploading a File. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types.

Section 34-22 Provisions of state sales tax statutes applicable to article states. A discount is allowed if the tax is paid before the 20th day of the month in which the tax is due. The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

Revenue Department 205 Govt St S. Manufactured Home registration is due October 1 and delinquent November 30. License Revenue Division 25 Washington Avenue 3rd Floor Montgomery AL 36104 Phone.

Delivery Spanish Fork Restaurants. Mobile AL 36652-3065 Office. Sales Tax County-Wide Tax Applies to all areas within Madison County including Redstone Arsenal.

SALES AND USE TAX. Manufactured home owners have 30 days after they purchase a manufactured home or 30 days after it enters into the state to register their manufactured home. Mobile County Al Sales Tax Registration.

Please forward the check for the sales tax to us along with the titleMSO Bill of Sale. Ad New State Sales Tax Registration. Click here to print the Application for Sales andor Use Tax.

You are most likely already paying your State salesuse taxes through ONE SPOT. 15 penalty will be assessed beginning February 1st through February 28th. Go to MAT.

30 penalty will be assessed beginning March 1st. You can read full instructions on how to register select tax types through My Alabama Taxes Help. The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile.

If you are currently setup to Electronically File State of Alabama SalesUse Taxes online step by step instructions for adding Montgomery County to your online filing through the MAT system are also available at revenuealabamagovsales-useone-spot. 800 to 300 monday tuesday thursday and fridays and 800 to 100 wednesdays. 1-334-844-4706 Toll Free.

Consumer Use Tax Registration. The City Council Finance Committee on Monday voted 2. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as 100 mail fee for decals.

States With Highest And Lowest Sales Tax Rates

Sales Tax Mobile County License Commission

Alabama S Severe Weather Preparedness Sales Tax Holiday Last Weekend In February Wpmi

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

Licenses And Taxes City Of Mobile

Pay Property Taxes In Mobile County Deadline Looms Al Com

Sales Tax Guide For Online Courses

Temporary Tags Alabama Department Of Revenue

Free Alabama Vehicle Bill Of Sale Forms Fill Pdf Online Print Templateroller

Alabama Sales Tax Guide For Businesses

Alabama Tax Title Registration Requirements Process Street

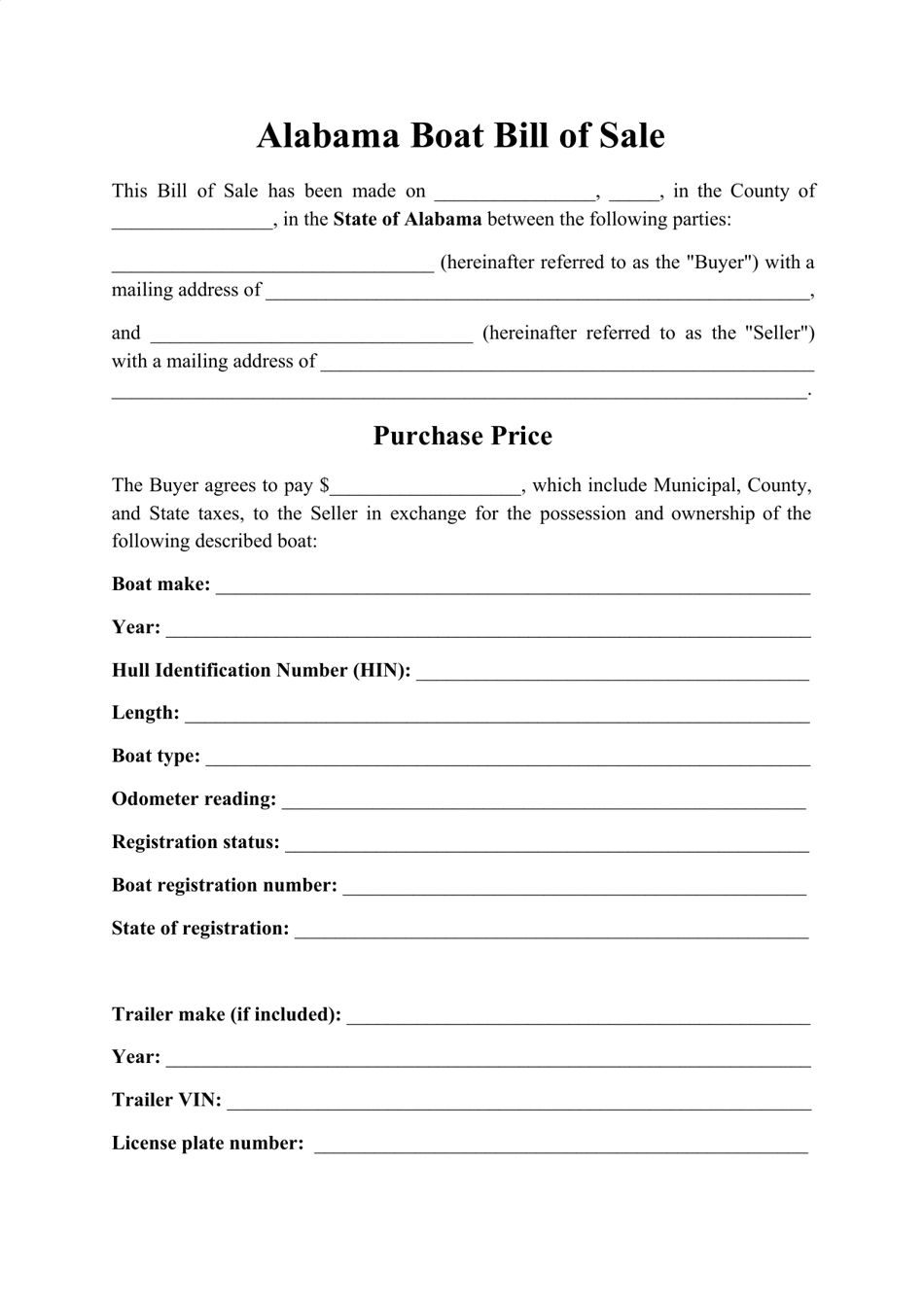

Alabama Boat Bill Of Sale Form Download Printable Pdf Templateroller

Alabama Tax Title Registration Requirements Process Street

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates

Alabama Tax Title Registration Requirements Process Street