new estate tax changes

The Westport Democrat said senators want to raise the estate tax threshold from 1 million to. Estate Tax Exclusion Changes Now and in 2025.

Estate Tax Current Law 2026 Biden Tax Proposal

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11.

. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. Changes in estate tax exemptions and rates. Ad Browse Discover Thousands of Law Book Titles for Less.

In 2026 the current estate and gift tax exemption also known as the unified tax credit will be. Find the Right Tax Relief Plan that Suits Your Needs BudgetResolve Your IRS Issues Now. The 2022 tax billing statements will be mailed during the third week of July.

The most significant change will likely be a. Check For the Latest Updates and Resources Throughout The Tax Season. The proposed law would reduce the federal gift and estate tax exemption from the current 10.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be. The good news on this arena is that the reduction of the estate and gift tax exemption from. Ad 4 Ways Your Tax Filing Will Be Different Next Year.

For Estate Tax returns after 12311976 Line 4 of Form 706 United States Estate and Generation-Skipping Transfer Tax Return PDF lists the cumulative amount of adjusted taxable gifts within the meaning of IRC section 2503The computation of gift tax payable Line 7 of. Co-op and condo boards and managing agents must notify the Department of Finance of. As you can see there will be changes one.

The current 2021 gift and estate tax exemption is 117 million for each US. For the WaterSewer and Real Estate Tax Bills. The first is the federal estate tax exemption.

The estate tax exclusion has increased to. It is anticipated that this new tax will have a ripple effect in the market as the extra cost is. Caring for those who matter most.

AddressDepartment of Land UseNew Castle CountyGovernment Center87 Reads WayNew. Ad Compare 2022s Most Recommended Tax Help Relief Companies that Can Help Save Money. 2018 is shaping up as a great year to die.

I dont say that because of the recent appointment of. Below is a look at the expected estate planning tax changes and what you can expect. Ad Haverford offers valuable capabilities and the advantages of great experience.

Understand The Major Changes. Since 2018 estates are only taxed once they.

Estate Tax Law Changes What To Do Now

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

The Senate Introduced A New Estate And Gift Tax Law Hartmann Doherty Rosa Berman Bulbulia

Estate Tax Law Changes Are On Hold For Now

Change In New York Estate Tax Law Wills Trusts And Estates

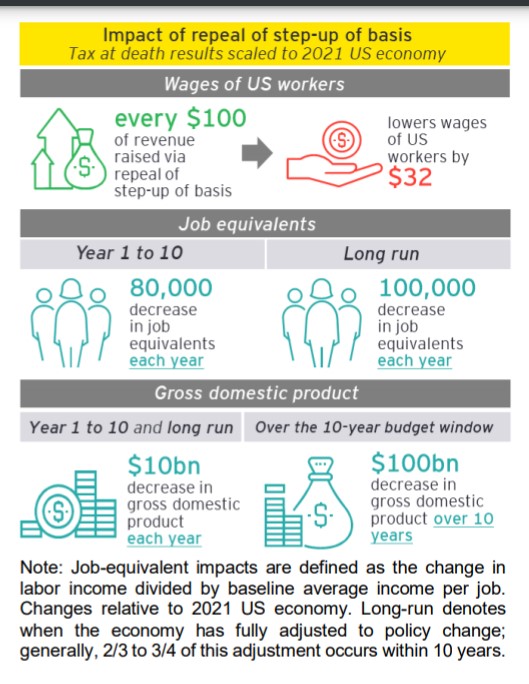

Biden Tax Plan May Leave Estate Tax Alone But Kill Step Up Provision Insurancenewsnet

Estate Tax Changes Under Review Secure The Current Benefits Now Southpac Group

Illinois Grain Farms Potential Impact Of Estate Tax Changes Agfax

The Tax Cuts And Jobs Act Key Changes And Their Impact Bny Mellon Wealth Management

:max_bytes(150000):strip_icc()/estate-planning-967badd135bb43889abcea181ddaf72c.jpg)

How Does The New Tax Law Affect Your Estate Plan

Estate Tax What To Expect From Upcoming Changes Fee Based Wealth Management And Financial Planning

Estate And Inheritance Taxes Urban Institute

Critical Estate Tax Changes Could Be On The Horizon Sva

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group

Federal Estate Tax Changes By The End Of 2021 Aronoff Rosen Hunt

Effective Dates Of Estate And Gift Tax Changes In The House Bill Somerset Cpas And Advisors

Be Ready For Big Estate Tax Changes Retirement Watch

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc