indiana department of revenue tax warrants

Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders and the Indiana Department of Revenue. Find Indiana tax forms.

The tax warrant can exist for the amount of unpaid taxes as well as interest.

. Tax Lien Balance Inquiry. Under IC 6-81-3 and IC 6-81-8-2. Ad Need Indiana Warrant Records Fast.

Our service is available 24 hours a day 7 days a week from any location. Doxpop provides access to over current and historical tax warrants in Indiana counties. Know when I will receive my tax refund.

Request Extension of Time to File. Lieberman Technologies is proud to provide Indiana Sheriff. The Indiana Department of Revenue DOR has the right under certain parameters to issue a tax warrant.

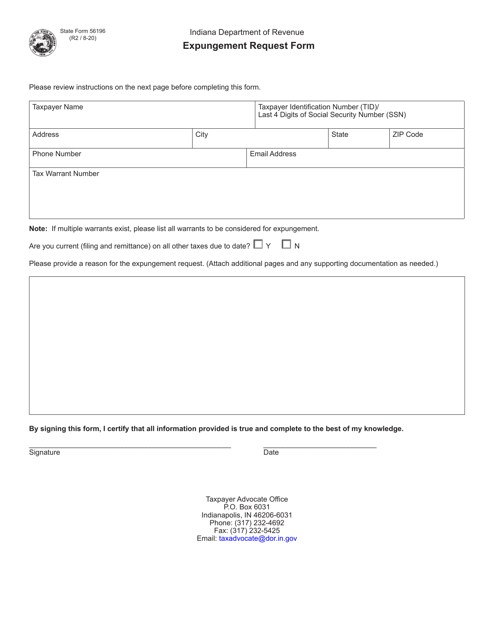

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Find Indiana Warrant Records In Our Online Database.

Implement the 25 Sheriff Process Fee for Tax Warrants. Occasionally it is necessary for the Indiana Department of Revenue DOR to issue bills for unpaid taxes. The Sheriffs Office then mails the respected letters to those individuals per request of the Department of Revenue.

1 Do not warrant that the. Check Your Payment Status. A Tax Warrant is not an arrest.

Tax Warrants letters are notices generated by the Collection Division of the Indiana Department of Revenue and are sent to the Sheriff of Huntington County for failure to pay state taxes. Under IC 6-81-3 and IC 6-81-8-2. The total due includes collection fees per Indiana Code 33-37-5-15.

Ad Official Updated Database -Find All Warrants for Anyone. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants. Saves you time paper and postage.

The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants. Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

If you are unsure if a letter email call or any other form of communication came directly from DOR or the Internal Revenue Service IRS contact DORs Customer Service Department at 317. A Tax Warrant is. A Tax Warrant is not an arrest.

2022 Official Updated Database -Find All Arrest Warrants for Anyone -All States Counties. About Doxpop Tax Warrants. Set up a Payment Plan.

See Advantages of ATWS over Paper. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional. Just Enter a Name to Begin Your Search.

What is a tax warrant.

States Tapping Historic Surpluses For Tax Cuts And Rebates Wset

Jill Glavan On Twitter Why Is The State Of Indiana Issuing Tax Warrants To An 11 Year Old Girl Her Mom Contacted Cbs4problemsolvers For Help And We Found Out It S Perfectly Legal I Ll Break

Can Indiana Issue A Warrant For Unpaid Taxes Levy Associates

Taxpayer S Guide To Indiana Dor Tax Warrants

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

Indiana Tax Warrant Joseph Pearman Attorney At Law

Scam Alert Fraudulent Tax Letters Claiming Distraint Warrant Cattaraugus County Website

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Sheriff Attempting To Claim 30 Years After A Mistaken Warrant Issued R Indianapolis

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller